This post was originally published on this site

It’s been a decade since the Greek debt crisis dominated financial news.

As the European Central Bank gets ready to embark on a rate-hike campaign — one official now is saying liftoff could come in June — and as Italian bond yields

TMBMKIT-10Y,

are now a full 2 percentage points higher than German bund yields

TMBMKDE-10Y,

Deutsche Bank strategist Maximilian Uleer decided to compare where the eurozone stood versus a decade ago.

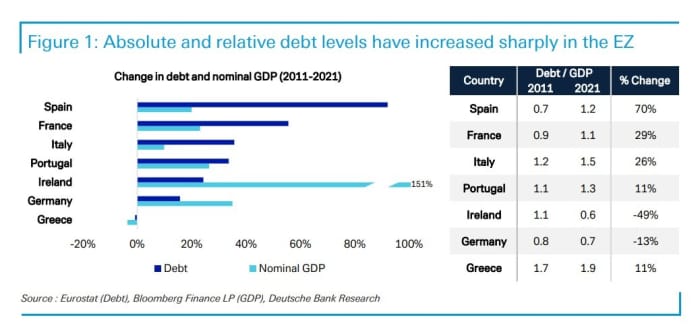

Relative and absolute levels have increased since 2011. Even with debt relief, Greece’s debt-to-GDP ratio is lower, because its economy has shrunk. Only Germany and Ireland, where companies have relocated to take advantage of lower taxes, have seen their debt-to-GDP ratios fall.

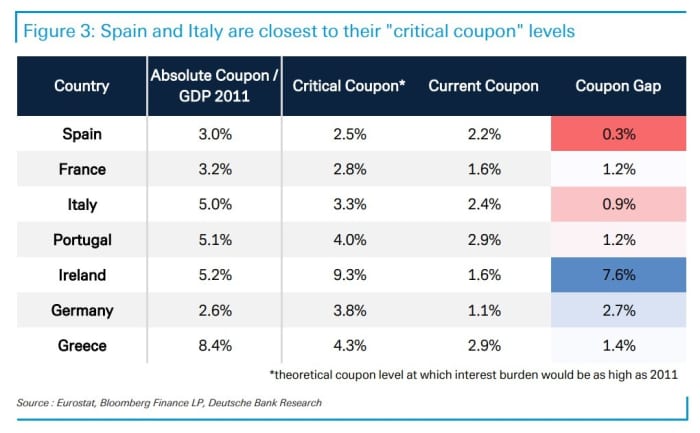

Granted, interest rates are lower. The weighted average coupon has fallen significantly, and the maturity of debt is longer.

Uleer said that Spain and Italy are most in danger of seeing their interest costs relative to GDP catch up to 2011 levels.

“Debt burdens have come down and the ECB has room to increase rates and stop its buying program. But the ECB’s degrees of freedom are limited. If rates were to rise sharply for longer, we might well be facing Euro Crisis 2.0,” said Uleer.

François Villeroy de Galhau, the Bank of France governor and European Central Bank governing council member, said Friday that it would be “reasonable” to have interest rates in positive territory by the end of this year, which would require three quarter-point rate hikes.

The euro

EURUSD,

edged higher on Friday but has dropped 7% vs. the dollar this year.