This post was originally published on this site

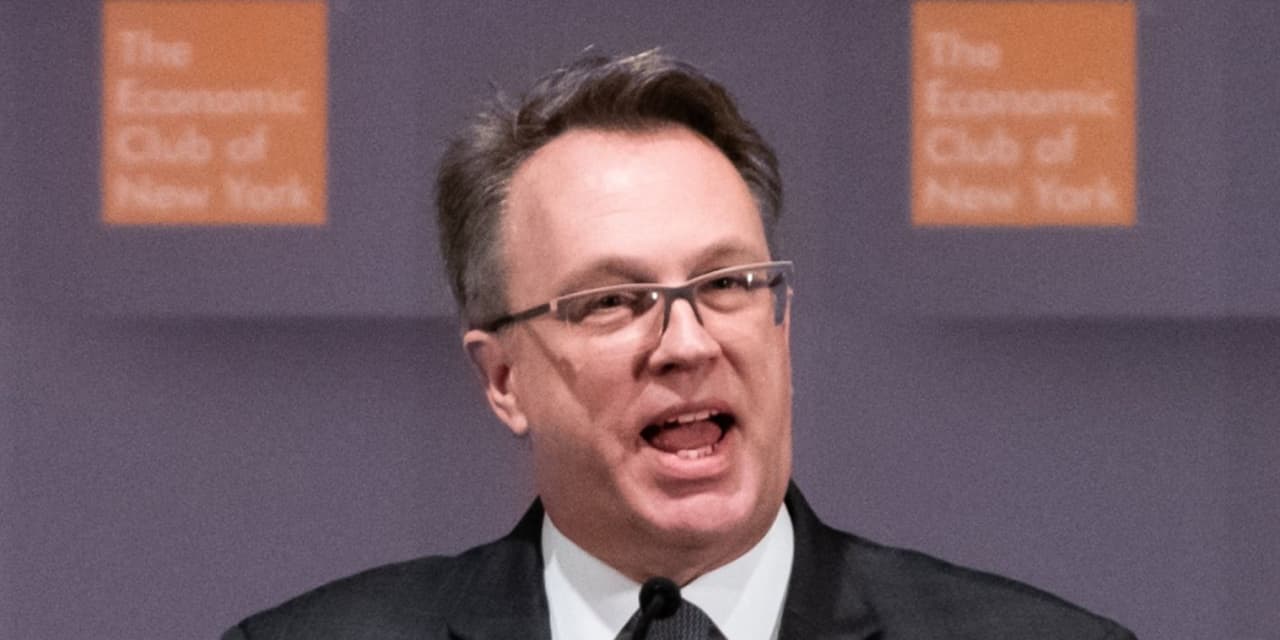

The president of the New York Federal Reserve said it would be “appropriate” to raise the central bank’s benchmark short-term interest rate in March and begin to reduce its $9 trillion stockpile of bonds “later this year.”

“With today’s strong economy and inflation that is well above our 2% longer-

run goal, it is time to start the process of steadily moving the target range [for short-term interest rates ] back to more normal levels” John Williams said in a virtual speech Friday at New Jersey City University.

Williams is seen as a close ally of Fed Chairman Jerome Powell, who has been quiet lately as he awaits a Senate vote on his confirmation for a second term. The Fed’s next strategy-setting meeting is March 15-16.

Williams didn’t tip his hand on whether he would prefer a quarter-point hike or 50 basis points in March, but most economists predict the Fed will start small as it typically does.

Nor did Williams specify a time by which the Fed should start to trim its balance sheet. Wall Street investors have been speculating intensely about those two questions.

Another Fed president, Loretta Mester, was also noncommittal in a speech on Thursday.

The Fed cut its benchmark short-term rate to near zero early in the pandemic and doubled the size of its balance sheet to $9 trillion by buying U.S. Treasury bonds and securities composed of home mortgages. The goal was to drive down long-term rates.

Williams said the Fed should move to “steadily and predictably” reduce its bondholdings. He noted that long-term rates have already risen in anticipation of the emerging Fed strategy.

Williams predicted inflation, as measured by the Fed’s preferred PCE index, would fall to around 3% by the end of 2022 from the current yearly rate of just under 6%.

He said supply-chain bottlenecks that have contributed greatly to high inflation are likely to subside and help to restore the balance between supply and demand.

The economy is likely to grow a shade less than 3% this year, he said.

“I am confident we will achieve a sustained, strong economy and inflation at our 2% longer-run goal,” he said.