This post was originally published on this site

Hopefully your stomach has been able to endure the extreme volatility, as of late. April was a fairly positive month on the valuation front, but there are always stock opportunities. Let’s buckle up and read Lanny’s Dividend Stock Watch List – May Edition.

Dividend stock watch list

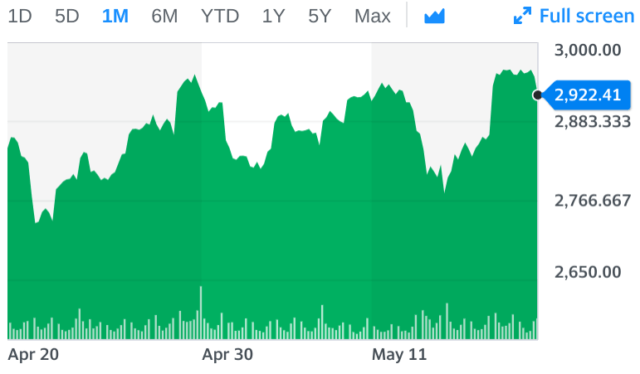

The stock market is up approximately 2.8% from 3rd week of April through May 19th. What has caused the increase? First, signs of vaccines for the coronavirus continue to come up, causing the market to react positively. Next, the stay at home orders and shutdowns are being lifted across industries, almost day by day and week by week. Therefore, the market is trading on the positive future outlook. However, I believe the Q2 earnings results will be completely dismal and that the market increase doesn’t make sense – especially with the expected 20-30% unemployment rates to come.

As a dividend stock investor, for the first time, I feel a little uncertain of what the future may hold. We continue to save and invest in very conservative dividend stock investments, in smaller purchases. I have written two articles related to the topic of the Coronavirus Dividend Stock Watch List and Industries that truly thrive during a pandemic. Therefore, by using the Dividend Diplomat Stock Screener, there is always an undervalued dividend stock up for grabs; that’s where Financial Literacy and Research pays off.

Here is a display of what the market did in the last 30 days:

In addition, capital is necessary to make any dividend stock purchase that is on this watch list. How do I do it? I save anywhere from 60-85% of my take-home pay and strongly believe Financial Freedom does not happen by hitting a home run on an investment. Nothing matters more than your savings rate on your journey to Financial Freedom, plain and simple.

Therefore, I work my butt off to make sure expenses remain in-check and that my savings rate is meeting our investment and financial independence goals! Then, you rinse and repeat.

Aflac (NYSE:AFL)

The duck that everyone knows and loves. Further, they are in an industry to invest in that is for LIFE. Everyone has some form of insurance – health, life, auto, home owners, renters, etc. That is why Aflac stands to be on my watch list, specially with the dividend history they have.

Further, their stock price has also dropped from the start of the year of $52.90, down to $33.63 as of May 19, 2020. That’s a 36% stock price drop year-to-date.

We have put Aflac through the Dividend Diplomat Stock Screener:

Price to Earnings (P/E) Ratio: Analysts of Aflac are projecting $4.34 in earnings per share for 2020. This represents a price to earnings ratio of 12.90, which is insanely low and is far more undervalued than the S&P 500 index or stock market as a whole.

Dividend Yield and Dividend Growth: Aflac is paying $1.12 in dividends per year. At a share price of $33.63, this dividend yield calculates to be 3.33%, well above the S&P 500 dividend yield and is slightly under my overall portfolio yield. Aflac is a beloved dividend aristocrat and increases their dividend approximately 1 cent per share, per quarter. The latest dividend increase was 3.7%, which is definitely appreciated during the pandemic.

Dividend Payout Ratio: In addition, based on projected earnings of $4.34 and a dividend $1.12 per year, the payout ratio is 26%. The dividend payout ratio significantly lower than the market, typically, but is in line with the industry standard. Aflac is leaving plenty of room for future dividend growth.

General Dynamics (NYSE:GD)

As stated in my April Dividend Stock Watch List, General Dynamics is one of the largest aerospace and defense corporations, the 6th largest in the world.

GD was trading at $176.35 at the start of the year and have dropped to $136.19, a 23% drop. Further, their yield has remained above 3%.

Price to Earnings (P/E) Ratio: Analysts of GD are projecting $11.47 in earnings per share for 2020. This represents a price to earnings ratio of 11.87, which is low and is more undervalued than the S&P 500 index or stock market as a whole. Somehow, even lower than Aflac!

Dividend Yield and Dividend Growth: GD is paying $4.40 in dividends per year. At a share price of $136.19, this dividend yield calculates to be 3.23%, above the S&P 500 dividend yield and is also below my portfolio yield, currently. They are a beloved dividend aristocrat, with a streak of over 25+ years and the most recent increase being 7.8%. An over 7% dividend growth rate, with a yield above 3%, that’s a great combination to have.

Dividend Payout Ratio: Based on projected earnings of $11.47 with an annual dividend is $4.40 per year, the pay out ratio is 38%. The dividend payout ratio is right at the lower range of the 40% to 60% we like to see. They keep a fairly sound balance between reinvestment back into the business and a return back to shareholders.

People’s United Financial, Inc (NASDAQ:PBCT)

The last dividend stock on my watch list was one that was on my May Dividend Stock Watch List. Peoples United is a $59 billion financial institution, based in Connecticut and I initiated my position with them back in April, and continued to add a few more shares into May. I had to go 3 for 3, for having dividend aristocrats as part of my watch list.

PBCT has seen their stock drop from $16.90 to start the year, down to $11.02, as of close on 5/19/2020. That’s a 35% drop, down $0.86 from last month or an additional 7%.

Price to Earnings (P/E) Ratio: Analysts of PBCT are projecting $1.05 in earnings per share for 2020. This represents a price to earnings ratio of 10.49, which is low and is more undervalued than the S&P 500 index or stock market as a whole.

Dividend Yield and Dividend Growth: PBCT is paying $0.72 in dividends per year. At a share price of $11.02, this dividend yield calculates to be 6.53%, well above the S&P 500 dividend yield and my portfolio’s overall yield. They’ve increased their dividend for 25+ years, the most recent increase being only 1.4%. Essentially, they are in the low growth, high yield frame, right now. They increase, usually, a quarter of a penny; i.e. $0.1775 to $0.18, per quarter. They increased their dividend towards the end of April.

Dividend Payout Ratio: The payout ratio is 69%, with the dividend at $0.72 and projected EPS of $1.05. A higher dividend payout ratio, but that is fairly typical for PBCT.

Given they’ve weathered everything over the last 180 years, I am confident they can endure this pandemic as well.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.