This post was originally published on this site

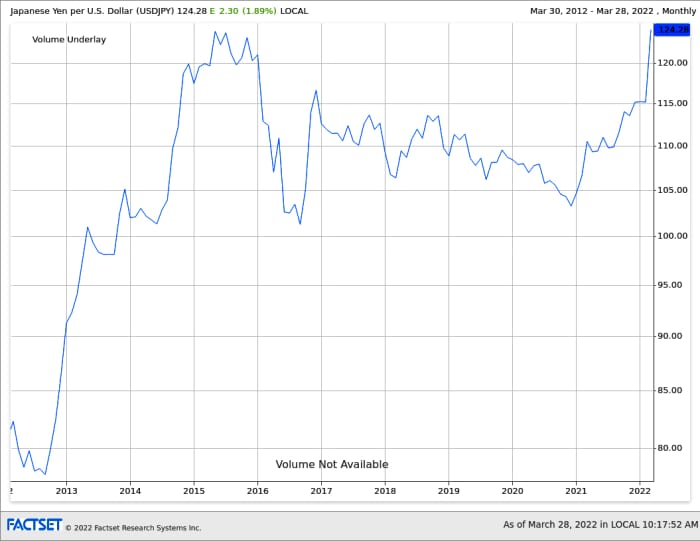

The Japanese yen continued to weaken against the dollar on Monday to a more than six-year low — plagued by a combination of rising global rates plus low growth and inflation relative to the rest of the world.

The yen traded around 124 yen per dollar as of Monday morning, the weakest level since July 2015, and traded briefly above 125 during European hours. Eisuke Sakakibara, Japan’s former top currency diplomat, is calling for the country to intervene in currency markets or raise interest rates if the yen weakens past 130 per U.S. dollar, reports say.

Source: FactSet

The country has already begun verbal intervention, with Japan Finance Minister Shunichi Suzuki indicating a preference for exchange-rate stability, and Bank of Japan Governor Haruhiko Kuroda offering similar remarks. The case for intervening today “looks mixed,” Goldman Sachs Group Inc.’s GS Zach Pandl and others wrote in a note Sunday. They said the USD/JPY USDJPY pair has typically been at 129-130 ahead of past interventions, and that the BOJ has not intervened to support a weak yen since June 1998.

“Depreciation pressure can continue” over the short term, but the yen’s “topside” will “eventually be contained by intervention,” said Pandl, co-head of global foreign exchange, interest rates and emerging markets strategy, and the others.

According to Sakakibara, known as “Mr. Yen” because of his impact on currency markets, Japanese authorities don’t need to act just yet. But a breach of the 130 level “could cause problems,” he was quoted as saying. If the breach occurs, Japan could conduct dollar-selling or yen-buying intervention, or start raising interest rates from ultralow levels, though successfully stemming the yen’s decline could be difficult, he said.

On Monday, the U.S. Dollar Index

DXY,

rose 0.5% as most Treasury yields slipped and U.S. stocks

DJIA,

COMP,

traded mixed in morning trading.