This post was originally published on this site

Investing.com – Cleveland-Cliffs Inc (NYSE:CLF) stock rose 4.5% on Monday after the company said it will buy Ferrous Processing and Trading Company to gain access to prime scrap and expand its portfolio of high-quality iron-ore pellets and other ferrous raw materials.

Cleveland has assigned FPT an enterprise value of approximately $775 million, on a cash-free, debt-free basis.

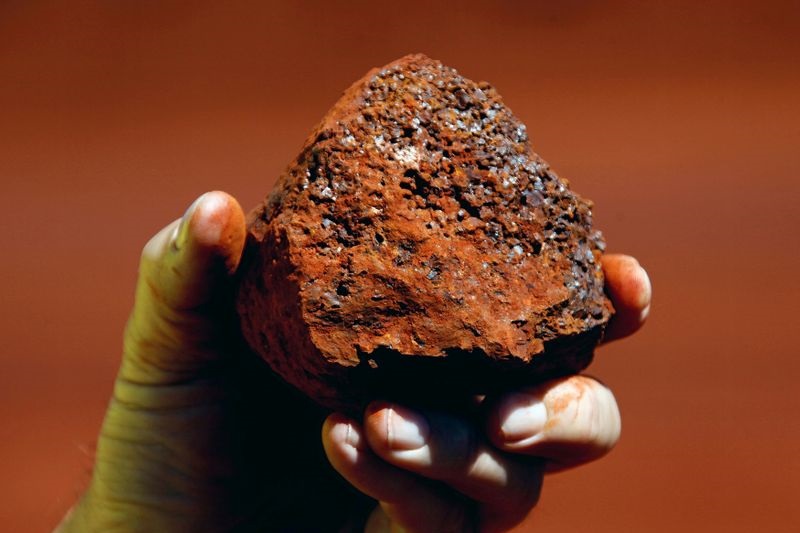

FPT is among the largest processors and distributors of prime ferrous scrap in the U.S., representing approximately 15% of the domestic merchant prime scrap market. It processes approximately 3 mtpa of scrap, approximately half of which is prime grade.

Cleveland-Cliffs’ CEO Lourenco Goncalves said that with all the new flat-rolled capacity coming online in the market over the next 4 years, prime scrap will become more and more scarce.

As the largest supplier of flat rolled steel in North America, Cleveland-Cliffs is the main source of the steel that generates prime scrap in manufacturing facilities. The buyer also consumes a very significant amount of scrap.

The acquisition will enhance the company’s ability to buy back prime scrap directly from its clients, cutting the middlemen and improving the margin contribution from scrap for both Cleveland-Cliffs and for the manufacturing and service center clients that will be able to sell scrap directly back to it, according to Goncalves.