This post was originally published on this site

Elevator Pitch

I downgrade my rating for Hong Kong-listed Mainland China property developer CIFI Holdings (OTC:CFFHF) (OTC:CFFDY) [884:HK] from Bullish to Neutral.

This is an update of my initiation article on CIFI Holdings published on September 24, 2019. CIFI Holdings’ share price has increased by +24% from HK$4.59 as of September 23, 2019, to HK$5.69 as of May 21, 2020, since my initiation with a Bullish rating. During the same period, the Hong Kong benchmark Hang Seng index was down by approximately -8%. CIFI Holdings also trades at 5.0 times consensus forward next 12 months’ P/E, which is on par with its historical three-year and five-year average consensus forward next 12 months’ P/E multiples of 5.4 times and 4.8 times, respectively.

I see limited share price upside for the company at current valuation levels, which explains my rationale for the rating downgrade.

Furthermore, CIFI Holdings has a relatively high level of offshore debt financing, which is a potential area of concern if USD strengthens against RMB and credit tightens in overseas markets. It is expecting a slower pace of contracted sales growth this year as a result of the coronavirus pandemic. There is also no spin-off catalyst for the company in the near-term.

Readers have the option of trading in CIFI Holdings shares listed either on the Over-The-Counter Bulletin Board/OTCBB as ADRs with the tickers CFFHF and CFFDY or on the Hong Kong Stock Exchange with the ticker 884:HK. For CIFI Holdings shares listed as ADRs on the OTCBB, note that liquidity is low, and bid/ask spreads are wide.

For CIFI Holdings shares listed in Hong Kong, there are limited risks associated with buying or selling the shares in terms of trade execution, given that the Hong Kong Stock Exchange is one of the major stock exchanges that is internationally recognized, and there is sufficient trading liquidity. Average daily trading value for the past three months exceeds $16 million, and market capitalization is above $5.7 billion, which is comparable to the majority of stocks traded on the US stock exchanges. Institutional investors who own CIFI Holdings shares listed in Hong Kong include The Vanguard Group, Norges Bank Investment Management, American Century Investment Management and AllianceBernstein among others. Investors can invest in key Asian stock markets either using U.S. brokers with international coverage, such as Interactive Brokers, Fidelity, or Charles Schwab, or local brokers operating in their respective domestic markets.

Relatively High Level Of Offshore Debt

CIFI Holdings’ net gearing and funding cost are in line with industry averages, and there are limited concerns in that respect.

The company’s net debt-to-equity ratio (including perpetual securities) or net gearing declined from 81.5% as of end-FY2018 to 78.9% as of end-FY2019. The average net gearing ratio of a list of 25 Hong Kong-listed Mainland China property developers which I track is in the 90%-100% range.

CIFI Holdings’ weighted average funding cost was 6.0% for FY2019, which is comparable to the average debt financing cost of around 6% for Mainland China property developers. At the company’s FY2019 results briefing on March 27, 2020 (audio recording and transcript not publicly available), the company highlighted that it expects to maintain its weighted average funding cost at below 6% for FY2020.

Other financial metrics also suggest a healthy financial position for the company. Debt-to-EBITDA and EBITDA-to-interest expenses ratios were 5.1 times and 3.5 times respectively for FY2019. As of December 31, 2019, CIFI Holdings also has sufficient liquidity with a cash-to-short term debt ratio of 2.7 times.

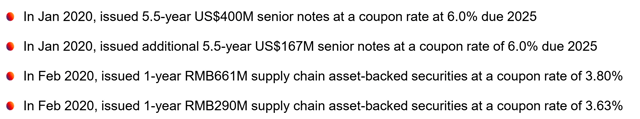

Nevertheless, it is worth noting that the company has a relatively high level of offshore debt financing. Offshore debt, typically USD-denominated debt which includes both bonds and bank loans, accounted for approximately 43% of total debt as of end-FY2019. The company also took on additional offshore debt financing since the beginning of FY2020, as per the chart below.

CIFI Holdings’ Financing Activities Since The Start Of 2020

Source: FY2019 Financial Results Presentation Slides

Source: FY2019 Financial Results Presentation Slides

If the USD continues to strengthen against the RMB and credit tightens in overseas markets, CIFI Holdings’ reliance on offshore debt financing could potentially be an area of concern.

On the positive side of things, the company has limited refinancing risks with only approximately a fifth of its debt maturing within a year, which includes $300 million of USD-denominated bonds due in May 2020.

Slower Pace Of Contracted Sales Growth Expected In FY2020

CIFI Holdings’ contracted sales grew by +32.0% YoY to RMB200.6 billion in FY2019. With the coronavirus pandemic being a drag on property sales in China in the beginning of the year, the company is expecting a slower pace of contracted sales growth this year.

CIFI Holdings guided at its FY2019 results briefing on March 27, 2020, that it is targeting RMB230 billion in contracted sales for FY2020, which implies a more modest +14.6% YoY growth.

On the surface, it seems that the FY2020 contracted sales target is relatively conservative, as it implies a sell-through rate of 60% on salable resources of approximately RMB380 billion for this year. As a comparison, CIFI Holdings has managed to achieve sell-through rates in the 65%-66% range historically. However, the year-to-date contracted sales have been disappointing. For the first four months of FY2020, contracted sales declined by -30% YoY from RMB50.13 billion in 2019 to RMB35.40 billion in 2020. It looks like the company has quite a bit of catching up to do in the remaining months of 2020.

While the near-term outlook for CIFI Holdings’ contracted sales seems bleak, the medium-term growth prospects are decent. Even with the company hitting the RMB200 billion contracted sales milestone last year, it remains confident of achieving a contracted sales CAGR of +20%-30% in the next few years. CIFI Holdings’ confidence is well-supported by the fact that it derived 74% and 48% of its contracted sales from first- and second-tier Chinese cities and the Yangtze River Delta region respectively in FY2019. Property demand in the first- and second-tier Chinese cities and the Yangtze River Delta region is expected to be more resilient than other parts of China.

No Spin-Off Catalyst In The Near-Term

Mainland China property developers with near-term catalysts in the form of a spin-off of their property management services businesses are in the spotlight, because of the opportunity for shareholder value creation from corporate actions. One example is KWG Group Holdings Limited (OTC:KWGPF) [1813:HK] which I wrote about recently in an article published on May 15, 2020.

CIFI Holdings does not belong to this category of companies, as it has already spun off its property management services business as a separately listed entity known as Ever Sunshine Lifestyle Services Group Ltd. [1995:HK] in 2018.

CIFI Holdings’ investment property business is a potential candidate for a spin-off in the future, but this is not likely to happen anytime soon.

The company’s investment property business grew its segment revenue by +125% YoY to RMB530 million in FY2019. CIFI Holdings is still growing the investment property business, and it could possibly consider a spin-off of this business unit if it reaches a certain scale. In FY2019, revenue from property management and other property-related services was five times that of the top line for the investment property business.

Looking ahead, CIFI Holdings is targeting to grow the revenue contribution from the investment property business to RMB700 million and RMB1 billion in FY2020 and FY2021 respectively.

Valuation And Dividends

CIFI Holdings trades at 6.3 times trailing 12 months’ P/E and 5.0 times consensus forward next 12 months’ P/E based on its share price of HK$5.69 as of May 21, 2020. In comparison, the stock’s historical three-year and five-year average consensus forward next 12 months’ P/E multiples were 5.4 times and 4.8 times, respectively.

The company is valued by the market at 1.18 times P/B versus the stock’s historical three-year and five-year mean P/B multiples of 1.34 times and 1.15 times respectively.

CIFI Holdings offers a historical FY2019 dividend yield of 6.6% and a consensus forward FY2020 dividend yield of 7.0%. The company proposed a final dividend of RMB0.2193 per share and a special dividend (20th anniversary for the company) of RMB0.0366 per share for 2H2019, which brought full-year FY2019 dividends per share to RMB0.3452.

The headline dividend payout ratio for FY2019 was 42%; if the special dividend was excluded, the adjusted dividend payout ratio for last year will be 37%. In contrast, the dividend payout ratio for FY2018 was a much lower 28%. Looking ahead, the company has guided at its FY2019 results briefing on March 27, 2020, that it will maintain a stable dividend payout ratio of around 35% going forward.

Risk Factors

The key risk factors for CIFI Holdings include an over-reliance on offshore debt financing, weaker-than-expected contracted sales growth, and lower-than-expected dividends in the future.

Note that readers who choose to trade in CIFI Holdings shares listed as ADRs on the OTCBB (rather than shares listed in Hong Kong) could potentially suffer from lower liquidity and wider bid/ask spreads.

Asia Value & Moat Stocks is a research service for value investors seeking value stocks with a huge gap between price and intrinsic value, leaning towards deep value balance sheet bargains (i.e. buying assets at a discount e.g. net cash stocks, net-nets, low P/B stocks, sum-of-the-parts discounts) and wide moat stocks (i.e. buying earnings power at a discount in great companies like “Magic Formula” stocks, high-quality businesses, hidden champions and wide moat compounders). Sign up here to get started today!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.