This post was originally published on this site

The Republican-controlled U.S. Senate passed a bill that requires US-listed Chinese companies to be audited by the Public Company Accounting Oversight Board will not deter us from endorsing China Distance Education Holdings Limited (DL) as a buy. The obvious undervaluation of DL compared to its peers in the Chinese education services industry should be taken advantage of.

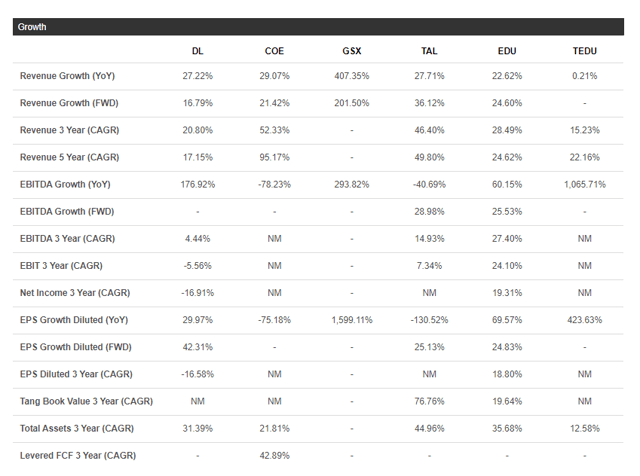

The peer comparison chart below exposed the deep-value quality of China Distance Education Holdings Limited. We are long on China Online Education Group (COE) and Tal Education Group (TAL). It is a no-brainer why we also want to exploit the current low 1.04x TTM EV/Sales and 9.14x forward P/E valuation ratios of DL.

(Source: Seeking Alpha)

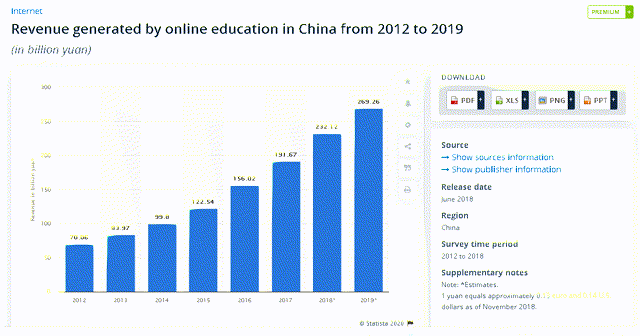

Going forward, DL is an affordable bet on the fast-growing online education industry of China. We remain long on COE and TAL because we expect their online platforms to get a big boost from COVID-19 quarantine and travel ban rules. The online education platforms of China Distance Education Holdings cater to adult Chinese learners. This is why DL is in a good position to reap the benefits from China’s 269.26 billion yuan ($37.89 billion) online education business. COE and TAL are mostly focused on tutoring K-12 students. DL services Chinese professionals and jobseekers wanting to learn new skills for career advancement purposes.

(Source: Statista)

The long-term prosperity of DL is not really endangered by the new U.S. senate bill. It did its IPO in 2008. SEC officials would have caught it a long time ago if DL’s Chinese management team is doing any creative accounting. It would also ruin DL’s reputation as an online accounting learning platform if gets involved in a creative accounting scandal.

Serving Adult Learners Is Profitable

We like China Distance Education Holdings Limited because it conducts online training to adult professionals who need training and certifications on law, engineering, IT, accounting, management, marketing, and other corporate skills. Most Chinese adult learners are already likely employed. Online adult learners who want to improve their accounting skills obviously will spend more than those parents wanting their K-12 kids to learn English as a Second Language.

DL is a buy because it is flourishing in its own niche. It does not compete directly with bigger Chinese education platforms. The emphasis on serving adult skills learners is partly why DL has a much lower growth rate than COE or TAL. DL’s management wisely decided not to compete in the crowded K-12 tutoring industry in China. Yes, DL will remain much smaller than TAL or EDU. Being a small but profitable player in China’s fast-growing online education industry is not a bad thing for China Distance Education Holdings.

DL’s lower valuation ratios (compared to its industry peers) is likely because of its 5-year revenue CAGR of 17.15%. This figure is obviously underperforming when compared to TAL’s 5-year revenue CAGR of 49.80%.

(Source: Seeking Alpha)

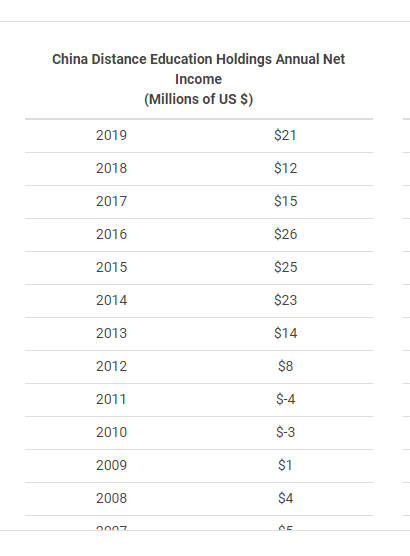

A lower revenue CAGR is just fine. Any company that is growing with a forward 3-year CAGR is already a legit growth stock. What is more important is that DL has been profitable since 2008. In our books, consistent profitability is still the more important metric when evaluating investment opportunities.

DL is a great long-term investment because it remains cheaply valued in spite of its constant profitability.

(Source: MacroTrends.net)

The latest quarterly report of DL was done yesterday. Q2 FY20 results showed the company beat revenue estimates again. DL’s Q2 revenue was $41.9 million (+8% year-over-year) and net income was $4.3 million. The company’s Q2 FY19 net loss was $3.9 million. The Q2 period covers January to March. This was when China’s COVID-19 was at its peak.

China Distance Education grew its revenue and boosted its net income while China was battling its worst pandemic months. China is again fighting new cases of COVID-19 infections. Worst, the new infections in North East China are caused by a different strain of the SARS-CoV-2 virus. Going forward, most Chinese citizens will elect to remain at their homes because the COVID-19 virus is mutating. Some of them will play video games or watch TV shows/movies all day long.

Some adult professionals will probably sign-up for an online course than play video games. DL has twenty online learning portals. Each website teaches a particular set of skills. Chinese citizens who want to improve their accounting skills or pass CPA exams can sign-up at DL’s chinaacc.com website. Those who want to learn and get licensed as forex & stock trading/financial securities professionals can go to DL’s ck100.com.

(Source: China Distance Education Holdings Limited)

Unlike the loss-making traditional classroom-based approach of TAL’s tutorial services, the online approach of DL tutorial/training services is profitable. DL does not lease or pay rent on thousands of learning centers.

Small annual net profits add up. DL touts an excellent balance sheet. It has zero debt and $130 million in cash & equivalents. The company’s current market cap is less than $236 million. It confounds us that investors gave DL a very low TTM Price/Sales ratio of 1.06x. DL is profitable – its sales achievement deserves a higher valuation.

Conclusion

DL is a strong buy because it is very affordable right now. DL caters to a niche of adult learners who are likely more affluent than K-12 students. Online education companies are getting a boost from pandemic quarantines. There’s no vaccine coming soon for the COVID-19 virus. The new normal is learn-from-home. China Distance Education Holdings is growing fast without sacrificing its bottom line.

China Distance Education has paid online portals that teach accounting and stocks/forex/bonds securities trading. This reason alone is why we don’t suspect the company of “creative accounting” like what Luckin Coffee (LK) did. It will be a fatal blow to this accounting-teaching company if it gets caught cooking the books. DL’s management could have fatten-up their annual revenue to boost the stock price if they wanted to. The fact that it has less than 20% 5-year revenue CAGR is already reassuring to us.

Going forward, DL can easily surmount the new U.S. Senate bill that requires Chinese firms to submit themselves to audit by the Public Company Accounting Board. China Distance Education Holdings can also easily declare that it is not a Chinese state-owned or state-controlled firm.

Disclosure: I am/we are long COE, TAL. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: If we can raise some cash, we will purchase some DL this month.