This post was originally published on this site

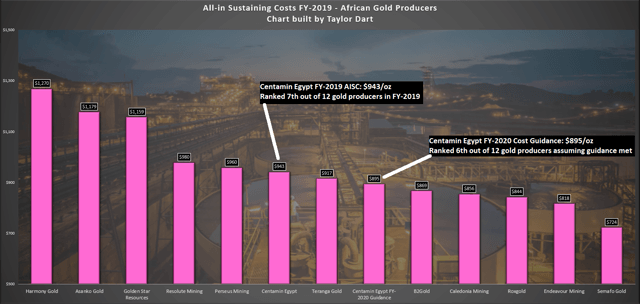

We’re more than two-thirds of the way through the Q1 earnings season for the Gold Miners Index (GDX), and we continue to see bifurcated results among the group, with many gold producers materially affected by COVID-19 restrictions, and other continuing to operate unabated. One company in the latter group is Centamin Egypt (OTCPK:CELTF), with no reported cases of COVID-19 and minimal disruption whatsoever to the company’s supply chain or operations. The intermediate miner remains on track to meet its FY-2020 production and cost guidance, and reported quarterly gold production of 125,000 ounces in Q1 while bolstering its balance sheet further to just shy of $400 million in cash/cash equivalents. Based on the company’s industry-leading balance sheet strength and dividend yield, I see the stock as one of the most attractive African producers. I would view 15% pullbacks in the stocks towards C$2.50 as buying opportunities.

(Source: Company Presentation)

(Source: Company Presentation)

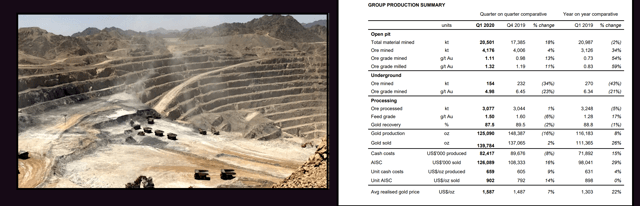

Centamin Egypt released its Q1 2020 results late last month, and the company reported quarterly gold production of 125,000 ounces, up 8% year-over-year from Q1 2019. These figures were well in line with the company’s FY-2020 guidance of 525,000 ounces, given that the company’s guidance is back-end weighted with the majority of ounces coming in H2 2020. Despite the COVID-19 related challenges, Centamin has maintained its outlook, and all-in sustaining costs came in more than 8% below the industry average at $902/oz for the quarter. Meanwhile, from a financial standpoint, the company’s operating cash flow soared by 18% year-over-year in Q1 to $110.5 million, helped by slightly lower capital expenditures and a higher gold price. Let’s take a closer look at the company’s operations below:

(Source: Company Presentation, Company News Release)

(Source: Company Presentation, Company News Release)

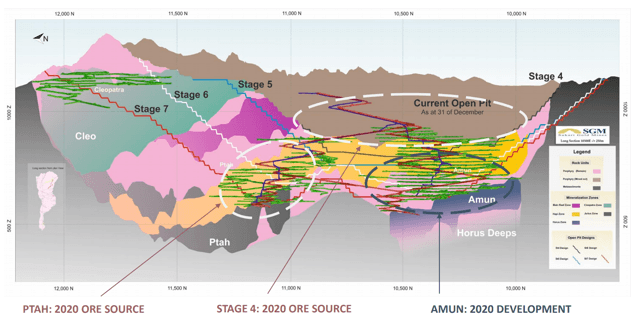

Centamin Egypt’s only producing asset is the Sukari Gold Mine in Egypt, and the mine had a solid quarter as noted. Sukari’s feed grades up 17% year-over-year, helped by much higher-grades from the Sukari open pit. These figures were up over 15% year-over-year from 1.28 grams per tonne gold in Q1 2019 to 1.50 grams per tonne gold in the most recent quarter. These higher grades were a result of the company mining the higher-grade Stage 4 West area, and Centamin benefited further from positive reconciliation on ore above 0.40 grams per tonne gold. The company’s plan is for the Sukari open pit to contributed 80% of total ounces in FY-2020, which is beneficial to the COVID-19 restrictions due to the ability to adhere to social distancing with open-pit mining more easily.

(Source: Company Presentation)

(Source: Company Presentation)

If we take a look at the underground operations at Sukari, the company’s mining is focusing on the Ptah Zone in FY-2020, with mined grades coming in 27% higher than budgeted, driven by higher stoping grades. This was a result of improved contractor management and dilution controls while mining. Total underground tonnes mined for Q1 came in at 154,000 tonnes at an averaged of 7.43 grams per tonne gold, translating to lower grades and tonnage year-over-year. While these figures decreased year-over-year, this was largely expected, and a function of the mine plan sequencing.

The one risk to Centamin’s operations in FY-2020 is that the underground portion of the mine is contractor-operated, while the open-pit portion of the mine is owner-operated. Therefore, given the reliance on contractors, the government-imposed travel restrictions could pose potential challenges and disruptions to operations if these restrictions last longer than expected, or become more stringent. However, the two pieces of good news are that underground ore makes up only 20% of the FY-2020 mine plan, and Centamin is proactively consulting with contractors to avoid disruptions to operations. Thus far, there have been no disruptions despite Egypt closing national borders, and there shouldn’t be any material disruption to operations unless the situation worsens and extends into Q3.

(Source: Company Presentation)

(Source: Company Presentation)

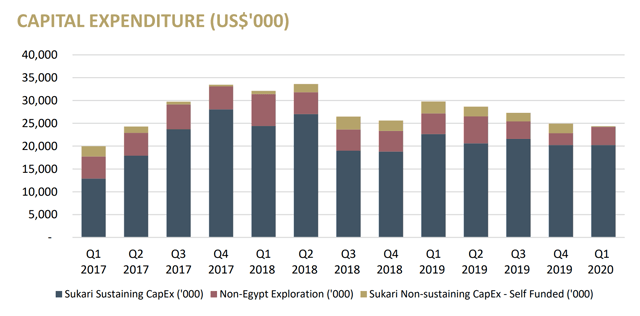

Finally, the company has taken a proactive measure to delay the Sukari Solar Plant to minimize contractor traffic on and off-site and reduce risk to employees in these difficult times. This has affected the company’s expected FY-2020 capital expenditures, reducing them from $190 million to $160 million at the guidance-midpoint. This should have a positive effect on free-cash-flow for the year, with expenses nearly 16% lower than expected.

(Source: Company Presentation)

(Source: Company Presentation)

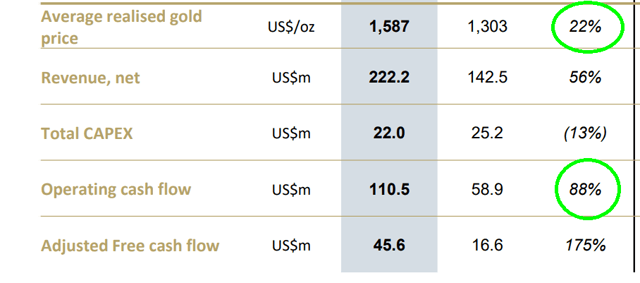

When it comes to financial metrics, Centamin had a blow-out quarter, with most of the help coming from the much higher average realized gold (GLD) selling price. In Q1 2020, the average gold selling price came in at $1,587/oz, up 22% year-over-year, and capital expenditures were slightly lower at $22.0 million in Q1, vs. $25.2 million in Q1 2019. This significant gold price tailwind led to massive growth in cash-flow for Centamin, with operating cash flow coming in at $110.5 million in Q1, up 88% year-over-year. Therefore, while all-in sustaining costs were up marginally year-over-year ($902/oz vs. $898/oz), the company has seen a massive tailwind from a profitability standpoint due to the gold price strength.

(Source: Company Presentation)

(Source: Company Presentation)

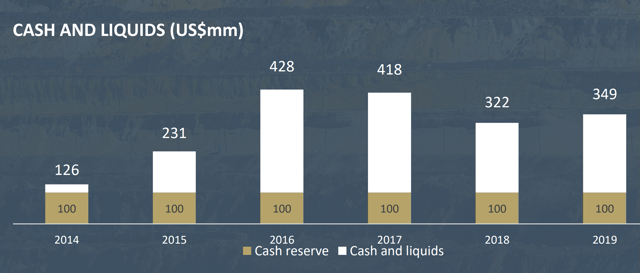

Not surprisingly, these strong results have led to continued improvement in the company’s balance sheet, with Centamin Egypt having one of the most substantial net cash positions in the industry. Currently, the company has no debt and a cash/cash equivalent balance of $349 million. Therefore, while the company’s market cap comes in at US$2.5 billion, the company’s current cash/cash equivalent balance makes up nearly 15% of this, giving the company an enterprise value of $2.15 billion currently. It’s also worth noting that despite the significant rally off of the mid-March lows and the more challenging operating environment for most miners, the company’s dividend yield remains at an industry-leading level over 4.0%, with US$0.10 paid out year last year in dividends. When factoring in the massive growth in operating cash flow, the industry-leading dividend yield, and the fortress-like balance sheet, Centamin stands head and shoulders above the rest of all other African producers.

Based on the fact that Centamin Egypt has coasted through the COVID-19 pandemic with minimal interruption to operations and no wavering with its significant dividend, it’s clear the company is better positioned than most gold producers to weather this storm. While there are undoubtedly other gold producers with better margins than Centamin, few can hold a candle to the company from a balance sheet and dividend yield standpoint. Therefore, I continue to see Centamin Egypt as a top-5 African producer and currently see the stock as a Hold. If we were to see any 15% pullbacks over the summer to the C$2.50 level, I would view this as buying opportunities.

Disclosure: I am/we are long GLD. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: Taylor Dart is not a Registered Investment Advisor or Financial Planner. This writing is for informational purposes only. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Taylor Dart expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.