This post was originally published on this site

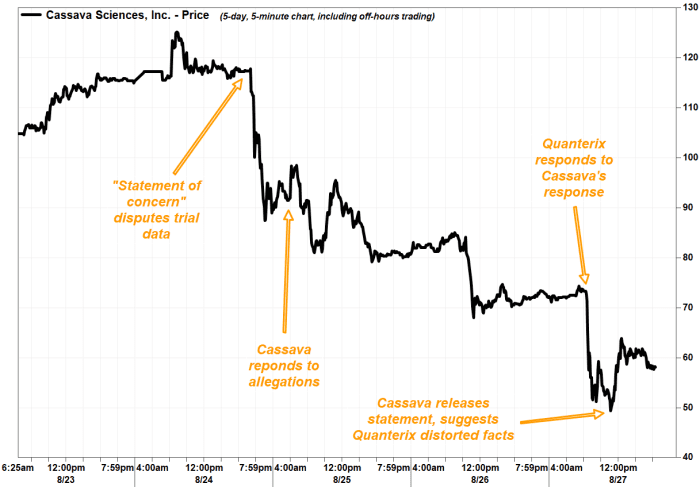

Quanterix Corp. took a swing at Cassava Sciences Inc. Friday, but then Cassava hit back, stressing that Quanterix was contracted to perform sample testing of the trial data that have been disputed.

Cassava’s stock

SAVA,

had tumbled as much as 30.4% earlier in the session to an intraday low of $49.29, but bounced back after releasing a statement at around 11:31 a.m. Eastern.

Still, the stock closed down 17.7% at $58.34, and has plunged 50.5% over the past three sessions.

The stock’s selloff this week kicked off with a 31.4% tumble on Wednesday, after a “statement of concern” was posted late Tuesday, requesting the Food and Drug Administration halt the clinical studies of Cassava’s simufilam, a treatment for Alzheimer’s disease. The post disputed the validity of clinical biomarker data, the integrity of western blot analyses and the integrity of analyses involving human brain tissue.

Cassava responded to the allegations early Wednesday, saying it believed the claims are “false and misleading.” In total, Cassava listed 15 “fictions” in the allegations, and followed each with “facts.”

The first “fiction” in the allegations Cassava noted was that biomarker data was generated by Cassava, or its science collaborators, and therefore are falsified. The company response was: “Fact: Cassava Sciences’ plasma p-tau data from Alzheimer’s patients was generated by Quanterix Corp., and independent company, and presented at the recent ‘Alzheimer’s Association International Conference.’”

Quanterix’s stock

QTRX,

fell 1.5% on Wednesday, then dropped 9.2% on Thursday.

Analyst Mayank Mamtani at B. Riley backed Cassava, saying he believed there were “numerous inconsistencies to the allegations,” and recommended buying the stock on weakness. Mamtani reiterated his buy rating and $145 stock.

FactSet, MarketWatch

Before Friday’s open, Quanterix released its own statement, acknowledging that Cassava previously engaged its Accelerator laboratory to perform sample testing based on blinded samples provided by Cassava.

But: “Quanterix or its employees did not interpret the test results or prepare the data charts presented by Cassava at the Alzheimer’s Association International Conference (AAIC) in July 2021 or otherwise.”

That helped lift Quanterix’s stock, which closed Friday up 9.4% at $50.30, to recover the bulk of what it lost the previous two days.

Quanterix’s statement sent Cassava’s stock sinking early Friday, to hit its intraday low a little after 11 a.m.

Then Cassava counterpunched. The company said it conducted the Phase 2b clinical study, while Quanterix’s “sole responsibility” was to test the samples, specifically to measure levels of p-tau in plasma samples.

“To ensure data integrity, it is standard industry practice to keep separate the people who generate the data from the people who analyze the data,” said Cassava Chief Executive Remi Barbier. “That certainly was the case here. Anything different is a distortion of the facts.”

Despite the recent weakness, Cassava’s stock was still up 755.4% year to date, while Quanterix shares have tacked on 8.2% and the S&P 500 index

SPX,

has gained 20.1%.