This post was originally published on this site

A key lesson that I’ve learned in investing is to have patience. And while I’m sure the audience at Seeking Alpha are primarily active traders, this article is geared towards readers that want to…

(Source: Medium.com)

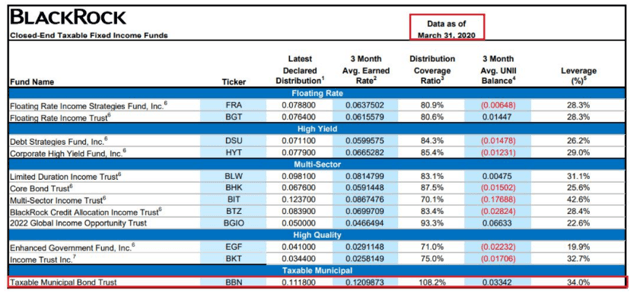

In researching an income solution, I came across the BlackRock Taxable Municipal Bond Trust (BBN). The fund is diversified, has great trading volume, and is a leader in Assets Under Management.

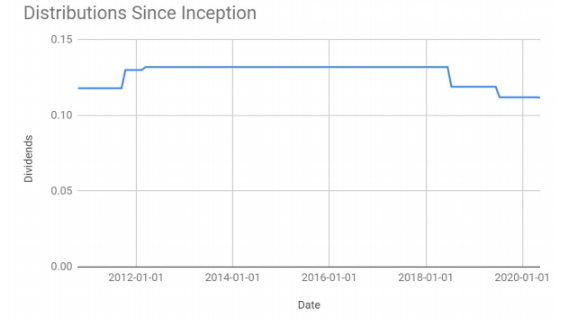

(Source: Yahoo Finance)

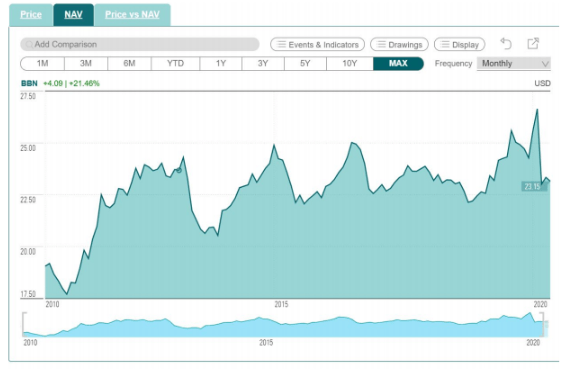

As you will see, the fund’s market price will fluctuate quite a bit because it is leveraged and sensitive to interest rates. The monthly distribution, though, has remained remarkably consistent over the years. This is important to income-seeking investors that want reliable monthly income. BBN may also be appropriate for those that don’t necessarily need immediate income because of the “DRIP” program that allows you to reinvest dividends at a discount and take advantage of compound growth.

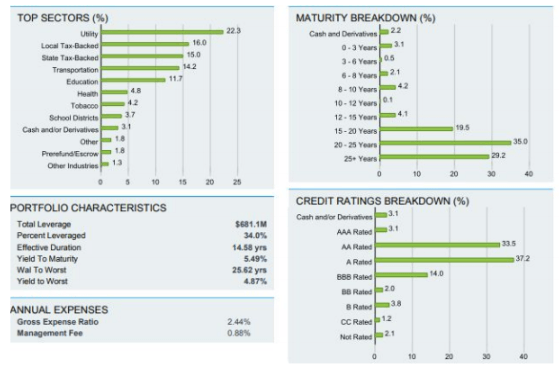

(Source: BBN Fact Sheet)

While impressive, the distributions are only half the battle. How can one be sure that your principal investment is safe? Several data points show how resilient this battle-tested fund is. The underlying holdings are very conservative with an emphasis on investment-grade revenue municipal bonds. Furthermore, the IG credit ratings are primarily A and above with default rates that are very rare.

A very important and perhaps underappreciated metric in the analysis of CEFs is NAV performance. A stable NAV can support a fund’s distribution and market price in troubled times. In the case of BBN, there have indeed been rather wild swings as it holds a leveraged portfolio of long-duration bonds, but NAV has held up amazingly well.

(Source: BBN annual report)

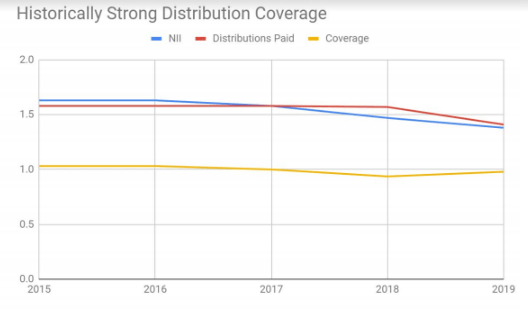

While past performance doesn’t guarantee future results, there is no escaping the fact that Net Investment Income (NII) Coverage is the main driver behind closed-end fund distributions. The above chart depicts BBN’s NII, distributions paid, and coverage ratio. While NII has modestly decreased as short-term borrowing rates have risen, it has remained historically consistent. I fully expect NII figures to improve going forward as the Fed has cut short-term rates in response to the COVID-19 Crisis. Additionally, coverage has remained very strong rates close to 100% year after year.

(Source: BBN Fact Sheet)

The Bottom Line

Overall, BBN is a well-established fund that is a great value and offers a current yield of 5.75%. Appropriate for both income seekers and growth investors, I urge prospective investors that are familiar with closed-end funds to take a look at this conservative, high-yield option.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.