This post was originally published on this site

Shares of Baker Hughes Co. rose Friday, after the oilfield products and services company announced plans to buy back stock for the first time in a year, with an aim to help sop up what General Electric Co. is selling.

Baker Hughes said its board of directors has authorized the company, through Baker Hughes Holdings LLC (BHH), to repurchase up to $2 billion worth of stock. Based on current prices, that could represent about 9% of the shares outstanding.

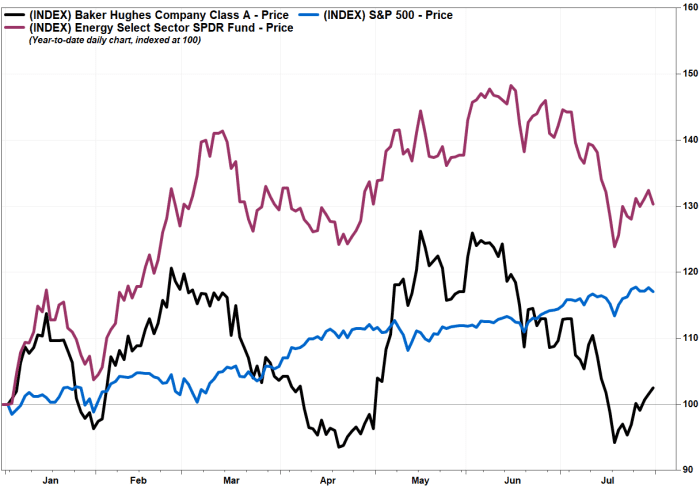

The stock

BKR,

climbed 0.8% in morning trading, to buck the weakness in its peer group and the broader market, as the SPDR Energy Select Sector exchange-traded fund

XLE,

dropped 1.7% and the S&P 500 index

SPX,

shed 0.5%.

The stock has now climbed 6.6% since it reported second-quarter results before the July 21 open.

If the company repurchases shares in the current third quarter, it would be the first it has done so since the third-quarter of 2020, according to filings with the Securities and Exchange Commission.

“We are pleased that Baker Hughes’ strong balance sheet and robust cash flow profile, which enables us to not only return value to shareholders through our regular quarterly dividend and share repurchases, but also enables us to invest for growth and position for new frontiers to lead the energy transition,” said Chief Executive Lorenzo Simonelli.

As part of the buyback program, Baker Hughes and BHH are authorized to enter into an agreement with General Electric

GE,

which is currently the fourth-largest shareholder according to FactSet, for BHH to shares from GE, with proceeds distributed to Baker Hughes.

Also read: GE stock jumps after surprise earnings beat, surprise swing to positive free cash flow.

FactSet, MarketWatch

In July 2020, GE said it was launching a program to “fully monetize” its stake in Baker Hughes over approximately three years. At that time, GE said the fair value of its interest in Baker Hughes was $5.91 billion.

Earlier this week, GE disclosed that it raised $1.0 billion in the second quarter from the sale of Baker Hughes shares and planned to sell about $1.3 billion worth of shares in the current third quarter.

On July 21, in Baker Hughes’ post-earnings conference call with analysts, BofA Securities analyst asked Chief Financial Officer Brian Worrell, according to a FactSet transcript, “why not do a buyback to help partially offset the continued drag on our stock from GE,” which continues to sell down its stake?

Worrell responded by saying beyond small-scale acquisitions and investments in new energy, “share repurchases can certainly be an attractive price of the capital allocation portfolio view.”

Baker Hughes stock has edged up 2.4% year to date, while the energy ETF has run up 30.2% and the S&P 500 has advanced 17.1%.